Why Accident Coverage Ruined My Portfolio — And How Asset Allocation Saved Me

I never thought a single accident could wreck my finances — until it did. What started as a minor injury turned into months of medical bills and lost income. I had insurance, sure, but my assets? Totally unprepared. That’s when I learned the hard way: accident coverage isn’t just about policies — it’s about how your money is actually arranged. This is the story of how I rebuilt my financial resilience through smarter asset allocation. While insurance covered part of the immediate costs, it didn’t restore my cash flow or protect my long-term goals. My retirement accounts were locked, my stock portfolio was too volatile to tap, and my emergency fund was barely enough to cover three weeks of expenses. In the months that followed, I had to sell investments at a loss and delay critical home repairs. The real lesson wasn’t about medical insurance — it was about financial structure. This article explores how a smarter approach to asset allocation can protect you not just from market swings, but from life’s unexpected disruptions.

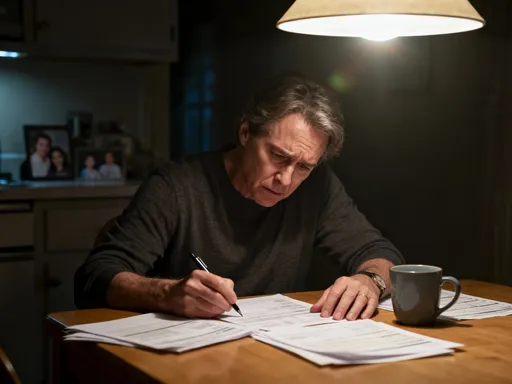

The Wake-Up Call: When an Accident Shattered My Financial Calm

It began with a fall — nothing dramatic, just a misstep on a wet kitchen floor. A fractured wrist, a cast, and a few weeks of discomfort. I assumed it would be a minor inconvenience, easily managed with my health insurance and a few days off work. But complications arose. Nerve damage required additional therapy, and the recovery stretched into months. Because I worked in a small business with no paid short-term disability, my income dropped by 70% during that time. Insurance covered the doctor visits and imaging, but not the physical therapy sessions beyond a certain limit, not the ergonomic equipment I needed to work from home, and certainly not the lost wages. Suddenly, I was facing $18,000 in out-of-pocket costs over six months — a sum that didn’t fit into my monthly budget.

That’s when I discovered the flaw in my financial setup. My emergency fund was in a high-yield savings account, but I’d already allocated most of it toward a planned home renovation. My largest assets were in a retirement account and a brokerage portfolio of growth stocks. While both were performing well on paper, neither could be accessed without penalties or market risk. Withdrawing from my 401(k) would have triggered taxes and early withdrawal fees, and selling stocks during a market dip meant locking in losses. I ended up borrowing from a home equity line of credit — a decision that added long-term interest costs to an already stressful situation. The accident itself was manageable. The financial fallout was not.

Looking back, the real failure wasn’t a lack of insurance. It was a lack of strategic asset design. I had built my portfolio to grow, not to protect. I focused on returns, not accessibility. I planned for retirement, not for disruption. This experience forced me to confront a hard truth: financial security isn’t just about how much you have — it’s about how quickly and safely you can use it when life goes off track. The wake-up call wasn’t the injury. It was the realization that my money, despite being substantial, wasn’t structured to support me in a crisis.

The Hidden Risk: Why Standard Accident Coverage Isn’t Enough

Most people assume that having accident or health insurance means they’re protected. But insurance policies, no matter how comprehensive, come with limitations. There are deductibles, co-pays, coverage caps, and exclusions for certain treatments or providers. Even with a solid plan, out-of-pocket expenses can accumulate quickly, especially when recovery takes longer than expected. In my case, my policy covered only 60% of physical therapy after the first ten sessions. Additional scans deemed “non-urgent” were not covered at all. These gaps may seem small at first, but over time, they create significant financial exposure — particularly when combined with lost income.

More importantly, insurance doesn’t address the timing of cash flow. Medical bills arrive weekly or monthly, but reimbursement can be delayed. Employers may not offer paid leave, and disability insurance often has waiting periods of 30 to 90 days before benefits begin. During that gap, you’re expected to cover all living expenses and medical costs from your own resources. If your money is tied up in long-term investments or retirement accounts, you face a difficult choice: take on debt, sell assets at an inopportune time, or delay care. None of these options are ideal — and all could jeopardize long-term financial health.

The deeper issue is that most financial planning focuses on either growth or protection, but rarely integrates the two. People invest for retirement, save for vacations, or budget for home repairs — but few plan for a scenario where income stops and expenses rise simultaneously. This is where asset allocation becomes critical. It’s not enough to have insurance; you must also have assets that are liquid, stable, and accessible when needed. The risk isn’t just the accident — it’s the mismatch between your financial structure and your real-life needs. Relying solely on insurance is like having a fire extinguisher but no escape route. You may survive the initial event, but you’re still trapped.

Asset Allocation 101: Building a Financial Safety Net That Works

After my accident, I revisited the fundamentals of asset allocation — not as a tool for maximizing returns, but as a strategy for building resilience. Asset allocation is the way you divide your investments among different categories: cash, bonds, stocks, and alternative assets. Traditionally, it’s used to balance risk and reward based on your time horizon and goals. But I began to see it as something more: a framework for ensuring that money is available when you need it, without derailing long-term plans.

I restructured my portfolio around three layers of financial protection: immediate access, short-term stability, and long-term growth. The first layer is the emergency fund — not just any savings, but one that’s highly liquid, low-risk, and mentally designated for unexpected events. I moved this into a dedicated high-yield savings account, separate from daily checking, with a clear target of six to nine months of essential expenses. This fund is now off-limits for non-emergencies, creating a psychological and practical barrier against misuse.

The second layer consists of short-to-medium-term instruments: short-duration bonds, money market funds, and laddered certificates of deposit. These are not designed for high returns, but for capital preservation and predictable income. If I ever face another income disruption, I can draw from this tier without selling stocks in a downturn. These assets act as a buffer, giving me time to assess the situation without making rushed financial decisions.

The third layer remains focused on growth — a diversified mix of index funds and dividend-paying stocks held in tax-advantaged accounts. This portion is untouched during short-term crises and continues to compound over time. The key insight was separating function from form: each part of my portfolio now has a clear purpose. The emergency fund handles shocks, the stable tier manages transitions, and the growth tier builds wealth. This layered approach doesn’t eliminate risk, but it ensures that a single event won’t force me to liquidate long-term assets at the worst possible time.

Liquidity vs. Returns: The Trade-Off Most Investors Ignore

One of the biggest mistakes investors make is chasing returns without considering accessibility. It’s tempting to put all available funds into high-growth assets like stocks or real estate, especially when markets are rising. But high returns often come with high illiquidity or volatility. Stocks can lose value quickly, and real estate can take months to sell. During a financial emergency, you don’t have the luxury of waiting for markets to recover. You need cash now — not next year, not when the Fed cuts rates, but immediately.

I learned this the hard way when I had to sell shares to cover medical bills. The market was down 12% that quarter, and I sold at a loss just to meet obligations. That decision not only hurt my portfolio’s performance but also delayed my recovery timeline, as I had to rebuild lost ground. If I had maintained a larger portion of liquid, low-volatility assets, I could have avoided that sale entirely. The trade-off between liquidity and returns is real, and it must be acknowledged in any sound financial plan.

The goal isn’t to avoid growth investments — they’re essential for long-term wealth. But it’s equally important to recognize that not all money should be working that hard. Some of it should be working quietly, preserving capital and ensuring availability. I now follow a simple rule: any money I might need within the next three to five years should be kept in stable, accessible forms. This includes funds for potential job transitions, major repairs, or health-related disruptions. By ring-fencing these needs, I protect my long-term investments from short-term pressures. This balance doesn’t guarantee comfort during a crisis, but it does prevent compounding losses — a critical distinction in financial resilience.

Real-Life Portfolio Fixes: What I Changed After My Accident

Rebuilding my financial strategy wasn’t about complex maneuvers or exotic products. It was about practical, sustainable adjustments that aligned with my life and risks. The first change was increasing my emergency fund from three months to eight months of essential expenses. I recalculated what “essential” meant — housing, utilities, groceries, insurance, and minimum debt payments — excluding discretionary spending. This gave me a clearer picture of what I’d actually need in a crisis.

Next, I restructured my investment accounts. I moved 15% of my brokerage portfolio from aggressive growth stocks into short-term bond funds and Treasury Inflation-Protected Securities (TIPS). These assets offer modest returns but with much lower volatility and better liquidity. I also set up automatic transfers to my emergency fund, treating it like a non-negotiable monthly bill. This ensures consistent replenishment, even when life gets busy.

I also reviewed my insurance coverage, not just for medical gaps but for income protection. I added a short-term disability policy with a 30-day waiting period — short enough to minimize the cash flow gap, but long enough to keep premiums affordable. I also looked into critical illness insurance, which provides a lump sum payment upon diagnosis of certain conditions. While not a replacement for health coverage, it adds another layer of financial breathing room.

Finally, I created a financial response plan — a simple document outlining what to do if income stops. It includes contact information for insurers, a list of essential expenses, and a drawdown sequence: emergency fund first, then stable tier, then growth assets only as a last resort. Having this plan reduced anxiety and gave me clarity. These changes didn’t make me rich, but they made me resilient. They transformed my portfolio from a collection of investments into a system designed for real life.

Preventing the Next Crash: Integrating Health Risks into Financial Planning

Accidents are unpredictable, but their financial impact doesn’t have to be. The best time to prepare is before a crisis hits. That means incorporating health-related risks into your regular financial reviews. Most people review their portfolios based on performance or market news, but few stress-test them against personal vulnerabilities. I now conduct an annual “financial resilience checkup,” where I ask: What if I lose 50% of my income for six months? What if I need long-term care? What if I have to support a family member?

This exercise helps me identify gaps and adjust my asset allocation accordingly. For example, if I’m taking on more caregiving responsibilities, I increase my liquid reserves. If I’m starting a new business, I extend my emergency fund timeline. I also look at buffer zones — the difference between my current savings and what I’d actually need in a worst-case scenario. If that gap is too wide, I adjust my spending or savings rate to close it.

Another key step is aligning risk exposure with life stage. A young investor with no dependents can afford to take more risk. But someone in their 40s or 50s, with a mortgage, children, and aging parents, needs more stability. I used to think of risk in terms of market volatility. Now I think of it in terms of life volatility — job changes, health issues, family needs. My portfolio reflects that shift. By planning for disruptions, I reduce the likelihood of financial injury when life delivers a blow. Prevention isn’t about fear — it’s about freedom. The more prepared you are, the more control you have.

The Bigger Picture: Wealth That Protects, Not Just Grows

Financial success is often measured in numbers: net worth, portfolio value, annual returns. But true wealth isn’t just about accumulation — it’s about endurance. It’s the ability to withstand setbacks without derailing your life. My accident taught me that a portfolio’s value isn’t just what it shows on a screen. It’s what it does when you need it most. A well-allocated portfolio isn’t just a growth engine; it’s a safety net, a shock absorber, a foundation for peace of mind.

By treating asset allocation as a protective tool, I’ve shifted my mindset from chasing gains to building resilience. I no longer measure success by quarterly returns alone. I measure it by how prepared I am for the unexpected. This doesn’t mean avoiding risk — that’s impossible. It means managing it wisely, with intention and foresight. It means having a plan that works not just in bull markets, but in hospital rooms, during job losses, and in moments of personal crisis.

Wealth that protects is wealth that lasts. It allows you to recover, adapt, and continue moving forward. It gives you the space to make thoughtful decisions instead of desperate ones. And in the end, that’s the greatest financial advantage of all: the freedom to live your life, even when things don’t go as planned. My portfolio didn’t save me from the accident. But smarter asset allocation saved me from its consequences. And that made all the difference.